In the intricate world of finance, understanding how interest accrues is crucial for informed decision-making. Whether you’re planning a savings strategy, contemplating a loan, or simply curious about the dynamics of interest, our Simple Interest Calculator guides you through the financial landscape. In this blog post, we’ll explore the functionalities of our calculator and how it empowers you to easily make sound financial choices.

Navigating finances can feel daunting, but with our Simple Interest Calculator, it doesn’t have to be. Understanding simple interest is crucial, whether you’re saving for a dream vacation, planning for a major purchase, or working through a loan repayment plan. Our tool takes the guesswork out of calculations, giving you instant clarity on how your money grows over time. It’s designed to be user-friendly, so you can focus on your financial goals without getting lost in numbers. With just a few clicks, you’ll see how interest adds up and empowers you to make informed decisions. Ready to take charge of your financial future? Let’s calculate your path to financial success together.

How to use our simple interest calculator

Our Simple Interest Calculator is not just a tool but a companion in your journey toward financial understanding and control. Experience its simplicity and utility today for smarter financial decisions tomorrow.

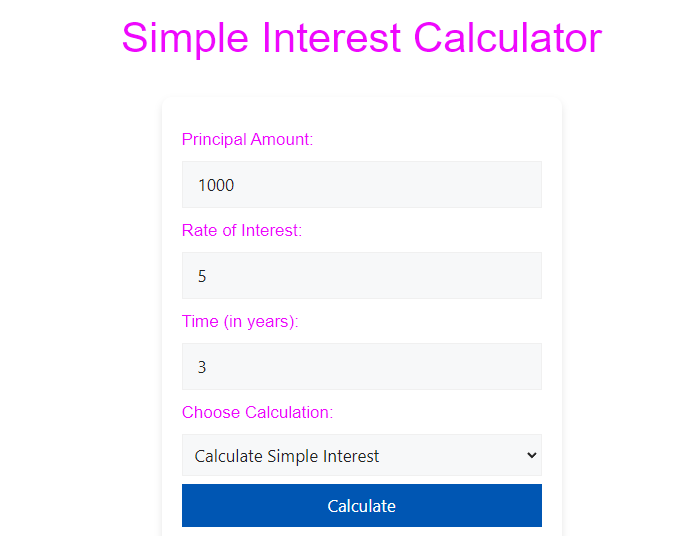

Step-by-Step Guide: This feature makes our tool unique and very easy to use for the user and also makes it user-interactive and attractive because this feature guides you in every step during calculation and avoids from any mistakes. These features also provide instructions to use it. The usage instructions are below:

Usage Instructions:

Using our Simple Interest Calculator is straightforward. Follow these simple steps to calculate interest accurately:

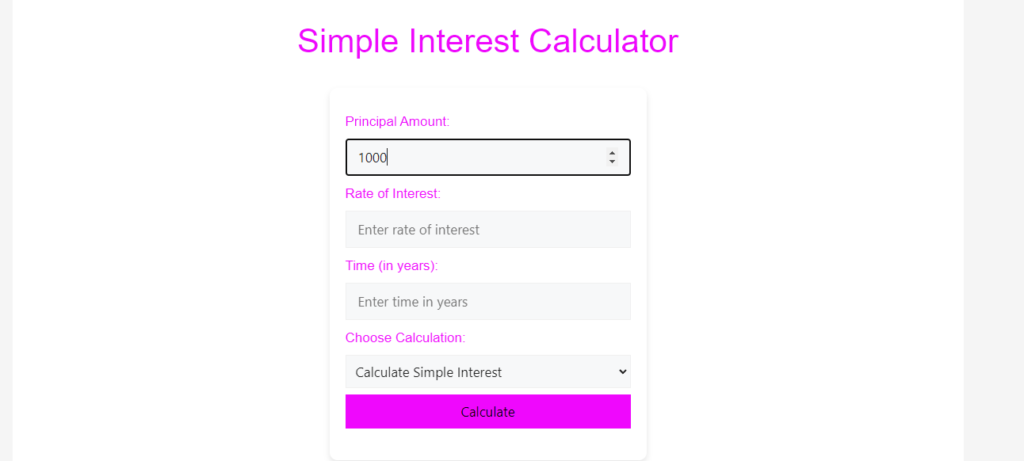

Enter Principal Amount:

Calculator Start by inputting the initial amount of money you borrowed or invested. you should input the principal amount by clicking enter the principal amount

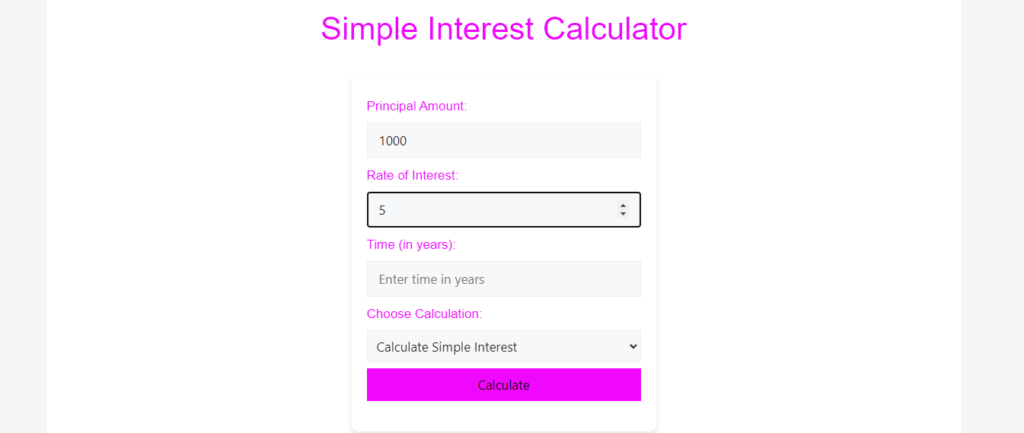

Input Annual Interest Rate:

Specify the annual interest rate as a percentage. This rate determines how much interest accrues over time. you should enter your interest rate.

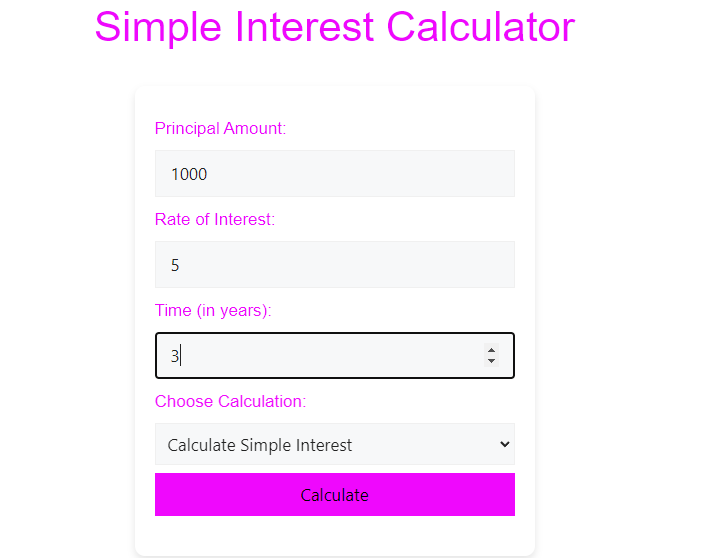

Specify time:

Select the time over which the interest will accrue. You can choose between years or months, depending on your calculation needs.

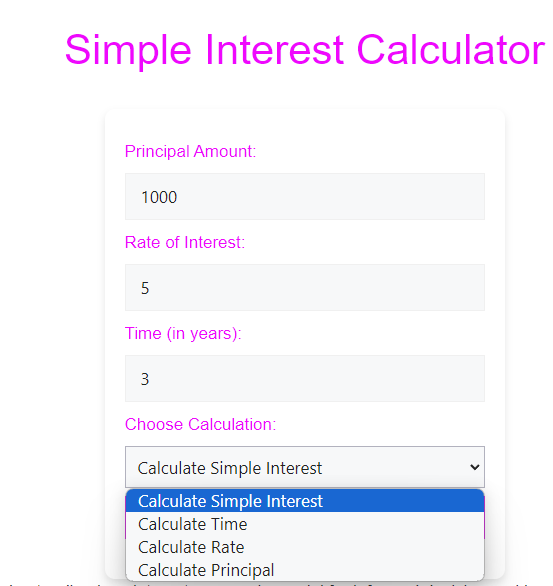

Choose the calculation:

This is the unique button in our tool that provides you with multiple options for your calculation in one tool. With the help of this button, you can select what you want to calculate, you can calculate time, interest, rate, and simple interest. If you want to calculate time, then click on time from multiple options. If you want to calculate interest rate then choose the interest rate option from multiple options.

Click Calculate:

Once you’ve entered all the required information, click the calculate button to instantly generate the simple interest amount.

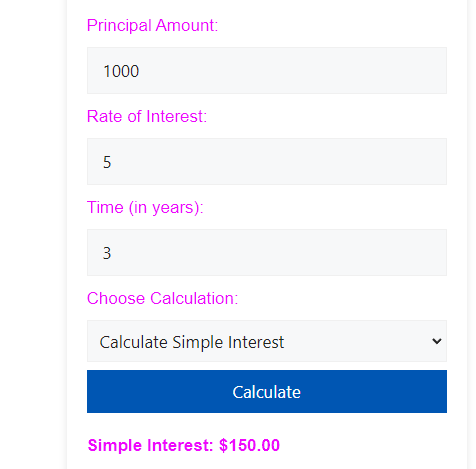

Example Calculation:

Let’s walk through a simple example to illustrate how our calculator works:

– Principal Amount: $1,000

– Annual Interest Rate:5%

– Time Period:3 years

Step-by-Step Calculation:

1. Interest Calculation Formula: \( I = P \times r \times t \)

where I=simple interest

p=principal amount

t=duration time

r=interest rate

2. Substitute Values:

P = $1,000

r = 5%

t = 3

3. Calculate Interest:

I = 1000 \times 0.05 \times 3

I = 1000 \times 0.15

I = $150

Result: The simple interest accrued on $1,000 at a 5% annual interest rate over 3 years is $150.

By following these steps, you can quickly and accurately calculate simple interest for any financial scenario, empowering you to make informed decisions about loans, investments, and savings.

Understanding Simple Interest

Before we dive into the capabilities of our Simple Interest Calculator, let’s grasp the concept of simple interest itself. Unlike compound interest, which accumulates on both the principal amount and the accumulated interest, simple interest is calculated solely on the initial principal. Simple interest is like the steady heartbeat of your financial transactions. It’s calculated on the original amount you borrow or invest, without the added complexity of compounding. Imagine it as a direct line from your initial investment to the interest earned or owed, calculated simply based on a fixed percentage over time. The formula is straightforward

[ simple interest=p*t*r/100 ]

where ( P ) is the principal amount, ( R ) is the annual interest rate, and ( T ) is the time (in years). Now, let’s explore how our Simple Interest Calculator can be your financial asset.

- Quick and Accurate Calculations:

Our Simple Interest Calculator takes the complexity out of interest calculations. Input the principal amount, interest rate, and time, and voila – receive instant and accurate results. No more grappling with complicated formulas or spending hours on manual calculations. - Empowering Savings Planning:

Planning to save for a future goal? Whether it’s a dream vacation or a down payment on a home, our calculator helps you project how your savings will grow over time. Adjust the variables to see how different interest rates or timeframes impact your financial goals. - Loan Decision Support:

Contemplating a loan? Our Simple Interest Calculator aids in understanding the financial implications of borrowing. Easily determine the total interest paid over the loan period and make informed decisions about the terms that best suit your financial situation. - Flexible Time Units:

The calculator accommodates various time units – whether you’re calculating interest over months or years, our tool provides flexibility to align with your financial planning preferences.

Importance of calculating simple interest:

Clear Financial Insight:

By calculating simple interest, you gain a clear picture of how much you’ll pay back on a loan or earn on an investment. It’s the clarity you need to make sound financial decisions.

Transparent Comparison:

When comparing different financial options, knowing the simple interest rate helps you see which one offers the best return or lowest cost.

Budgeting Confidence:

Whether you’re borrowing money or investing in savings, understanding simple interest gives you confidence in planning for future payments or earnings.

Education and Empowerment:

Learning to calculate simple interest empowers you with a basic financial skill that’s essential for managing personal or business finances effectively.

In my view simple interest isn’t just about numbers; it’s about understanding the heartbeat of your financial journey and using that knowledge to navigate toward your financial goals with clarity and confidence.

Tips for Optimizing Your Simple Interest Calculations:

To make the most of our Simple Interest Calculator, consider these tips:

- Experiment with Variables: Adjust the principal, interest rate, and time parameters to explore different financial scenarios. This flexibility allows you to tailor calculations to your unique circumstances.

- Educational Resource: Our calculator serves as an educational tool, helping users understand the fundamentals of simple interest. Use it to enhance your financial literacy and make informed decisions.

- Printable Results: Easily print or save your results for future reference. This feature is handy for sharing information with financial advisors or keeping a record of your calculations.

Here`s our Tool Description based on two main things:

- Functionality:

Our Simple Interest Calculator is your financial ally, effortlessly computing interest based on three essential factors: the initial principal amount, the annual interest rate, and the duration over which interest accrues. Here’s a glimpse into its workings:

- Streamlined Inputs: Enter the principal amount you borrowed or invested, the annual interest rate (as a percentage), and specify the duration in years or months.

- Swift Calculation: With a single click, our calculator swiftly crunches the numbers, providing you with precise results instantly.

- Versatile Application: Whether you’re a student exploring the basics of interest or a seasoned professional making critical financial decisions, our tool adapts to your needs with its intuitive interface.

2. User Benefits:

Using our Simple Interest Calculator offers compelling advantages:

- Efficiency: Save valuable time by sidestepping manual computations. Our calculator delivers results swiftly, enabling you to focus on strategic financial planning.

- Reliability: Minimize errors inherent in manual calculations. Our tool ensures accuracy, instilling confidence in your financial forecasts and decisions.

- Educational Resource: Perfect for educational purposes, our calculator simplifies the concept of simple interest, engagingly promoting financial literacy.

- Empowered Planning: Whether you’re budgeting for a loan or assessing the profitability of an investment, our calculator equips you with the clarity needed to plan effectively.

Benefits and application:

For your better understanding, we create questions below with their answer which makes you sound clear on our tool

- Discuss how users can use the calculator for financial planning (e.g., estimating savings growth, loan interest) :

Our Simple Interest Calculator serves as a powerful tool for effective financial planning in various ways:

- Estimating Savings Growth: Whether you’re saving for a vacation, a down payment, or retirement, our calculator helps you forecast how much interest your savings will accrue over time. This insight allows you to set realistic savings goals and track your progress toward achieving them.

- Loan Interest Assessment: When borrowing money, understanding the interest payments is crucial for budgeting and repayment planning. Our calculator provides clarity on how much interest you’ll pay based on the loan amount, interest rate, and loan term. This enables you to choose the most affordable loan option and manage your debt responsibly.

2. How it is a learning resource for understanding financial concepts. (like an educational tool)

Beyond practical applications, our Simple Interest Calculator serves as an invaluable educational resource:

- Concept Clarity: For students and anyone new to financial concepts, our calculator simplifies the understanding of simple interest. By experimenting with different values and observing how changes in principal, rate, and time affect interest calculations, users can grasp these fundamental financial principles more effectively.

- Interactive Learning: The calculator encourages interactive learning by allowing users to input different scenarios and see immediate results. This hands-on approach fosters engagement and enhances the retention of financial knowledge.

Visual aids play a crucial role in understanding our Simple Interest Calculator’s interface:

- Clear Interface: The calculator features a clean, intuitive design that prominently displays input fields for principal amount, interest rate, and period.

- Interactive Elements: Visual cues guide users through each step of the calculation process, ensuring ease of use and reducing the likelihood of errors.

User-Friendly Design:

Our Simple Interest Calculator is designed with user convenience in mind:

- Intuitive Navigation: Users can navigate effortlessly through the calculator’s fields, adjusting values as needed and seeing instant updates in results.

- Responsive Design: Accessible on desktops, tablets, and smartphones, ensuring seamless usability across devices.

- Helpful Prompts: Tooltips and explanations are strategically placed to assist users in understanding each input and result

In Conclusion:

Empower yourself in the realm of finance with our Simple Interest Calculator. Whether you’re planning for the future, navigating loan options, or simply exploring the world of interest, this tool is designed to simplify the complexities and make financial calculations accessible to all. Try it today and embark on a journey towards informed financial decisions!

Disclaimer: While our Simple Interest Calculator is designed for general use, users are encouraged to seek professional financial advice for specific and personalized financial planning. Results are based on standard simple interest calculations and may not account for unique financial scenarios or external factors.

Take control of your financial planning today with our Simple Interest Calculator:

- Calculate Your Interest Now! Gain immediate insights into your financial commitments and potential savings.

Your input matters! Help us improve our calculator:

- Share Your Feedback: We value your suggestions for enhancing user experience and functionality. Let us know how we can serve you better.